Comprehensive Insurance Cashless

A comprehensive insurance policy offers many benefits, including cashless claim settlement. It also helps you avoid paying out of pocket in the event of an accident or theft.

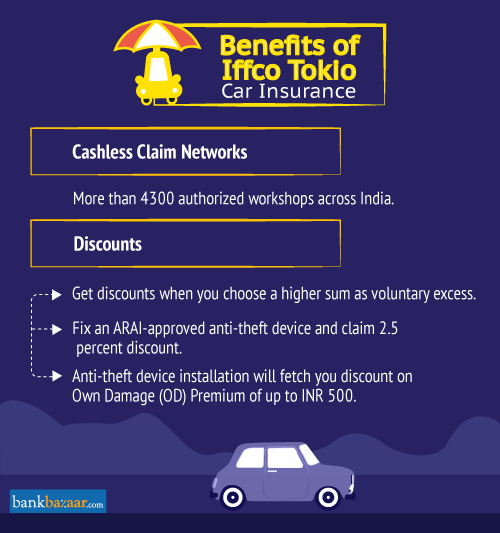

Cashless claims in car insurance have become the preferred mode of claim settlement. The process is easy, fast, and convenient for both the insurer and the customer.

The policyholder visits a network garage associated with the insurance provider, and the work is done without any upfront payment. After evaluation of the damage, the garage sends a bill to the insurance company, as per the terms and conditions of your policy.

However, it is important to understand that this facility does not eliminate the need to pay a portion of the bill, in the form of deductibles and depreciation, as per the policy.

Website design By BotEap.comwhat is comprehensive car insuranceLet’s say you have a friend who has been diagnosed with a serious ailment and needs to be admitted to a hospital for an operation. While you would be happy to assist him in the process, you are a little hesitant about whether he will have enough money to pay for his treatment.

Fortunately, the hospital has a health insurance representative who will help your friend with his documents and payments, ensuring that the process is seamless. In fact, most hospitals have insurance representatives on their premises and someone from the insurance company will be on hand to handle your friend’s medical expenses directly with them.

Website design By BotEap.com

Is Comprehensive Insurance Cashless?

In a similar way, when your car is damaged due to an accident or theft, the policyholder can take it to a network garage, and it will be repaired without any upfront payment. The garage will then send a bill to your insurer, as per the terms and conditions of your comprehensive insurance policy.

Website design By BotEap.comDefinition of Comprehensive Car InsuranceWhile you are at the garage, your insurer will make a claim on your behalf for reimbursement of the cost of repair. The amount will be directly credited to your account, which will help you manage your financial affairs better in the long run.

You can also avail cashless service on certain parts of your vehicle – such as rubber, plastic, and battery components – that are subject to high wear and tear. You will only have to pay for a part of the replacement cost, which is called depreciation.

Website design By BotEap.comWhat Comprehensive Car Insurance EntailsThe depreciation is a measure to compensate for the loss of value in your car, and is only applicable when the total amount paid out of your policy is less than the actual worth of your vehicle at the time of loss. Moreover, depreciation will only apply to a limited number of parts.

In addition, you can opt for cashless claims on your two-wheeler too if you have a comprehensive motor insurance cover. When you visit a network garage for your two-wheeler repairs, the garage will also send a bill to your insurer. Your insurer will then reimburse you the total amount of the claim, as per the terms and conditions of your insurance policy.